Shannon Maynard is Director of Bankers without Borders® (BwB), Grameen Foundation’s skilled-volunteer initiative. Maynard has more than 15 years of experience in nonprofit management and volunteer mobilization. Before joining Grameen Foundation, she served as Executive Director of the President’s Council on Service and Civic Participation, and managed strategic initiatives for the Corporation for National and Community Service, a federal agency. This post is the third in a four-part series; you can read her first post here, and her second post here.

“Things move more slowly in Africa” – this is a common refrain for many of us at Grameen Foundation when we find ourselves experiencing hurdles with our work in places like Nigeria and Ethiopia. In fact, African countries and the organizations we work with do often lack the infrastructure – particularly the Internet connectivity – that contributes to the fast-paced, rapid-response world that those of us based in the United States have grown so accustomed to. Slower is also a word I’d use to describe Bankers without Borders’ own presence in Sub-Saharan Africa.

Joining Grameen Foundation after primarily working with US-based NGOs, I remember my own first experiences arranging a call with a microfinance institution (MFI) leader in Sub-Saharan Africa – fumbling around with Skype to enter the correct phone number, then getting a voicemail message in a language I couldn’t understand. It might take a few weeks of trying to connect at a time convenient for us both. In those early days, Grameen Foundation did not have local offices or staff in places like Nairobi, Accra or Kampala. Cultivating relationships and managing projects is difficult to do from a different continent, which is why I am amazed we were actually able to do any work in places like Ghana and Nigeria in those first few years of BwB.

Over the past year, however, BwB has been able to gain some traction in the region, thanks to the regional leadership of Erin Conner and Steve Wardle, and BwB Regional Program Officer Martin Gitari, all based in Nairobi.

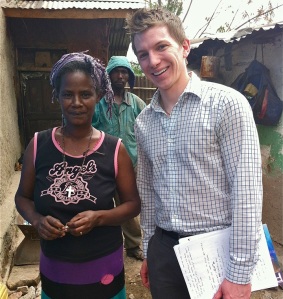

David Washer (right) spent a week meeting clients and lending his skills in finance to Eshet, an Ethiopian microfinance institution, as part of BwB’s Financial Modeling Reserve Corps.

Grameen Foundation’s own programs, particularly our MOTECH work in Ghana and Community Knowledge Worker (CKW) program in Uganda, are BwB’s biggest clients. In our early days, we had a hard time convincing Grameen Foundation’s own technology teams of the services we could provide, because Grameen Foundation’s own employees assumed BwB was only focused on connecting bankers with microfinance institutions (a fair assumption, given our name). Thanks to some education on our part and the willingness of these programs’ leaders to give us a try, we’ve been able to place volunteers such as Chris Smith and Gillian Evans (a husband-and-wife team) with CKW and Roche employee Lynda Barton with MOTECH, in year-long placements. We’ve worked with CKW to establish a local collaboration with Makere University to provide interns to our Uganda office each semester. And we’ve just finalized arrangements to engage a Glaxo Smith Kline employee with the CKW team on a six-month assignment, starting this month.